Mortgage Blog

Your Trusted Airdrie and Cochrane Mortgage Planner

When you hear Mortgages think Patricia

2025 Income Tax Filing: How Your Tax Return Impacts Mortgage Approval in Alberta

December 16, 2025 | Posted by: Patricia McKean - Cochrane and Airdrie Mortgage Broker

Your tax return isn’t just about CRA. For self-employed and variable-income borrowers, how you file can shape your mortgage options in 2025 and 2026. Planning before you file matters.

If you’re thinking about buying, refinancing, or renewing a mortgage in 2025 or 2026, your tax return matters more than most people realize.

This article is written by our mortgage team, with decades of experience helping self-employed and variable-income clients navigate approvals, and it’s something we talk about at kitchen tables every winter.

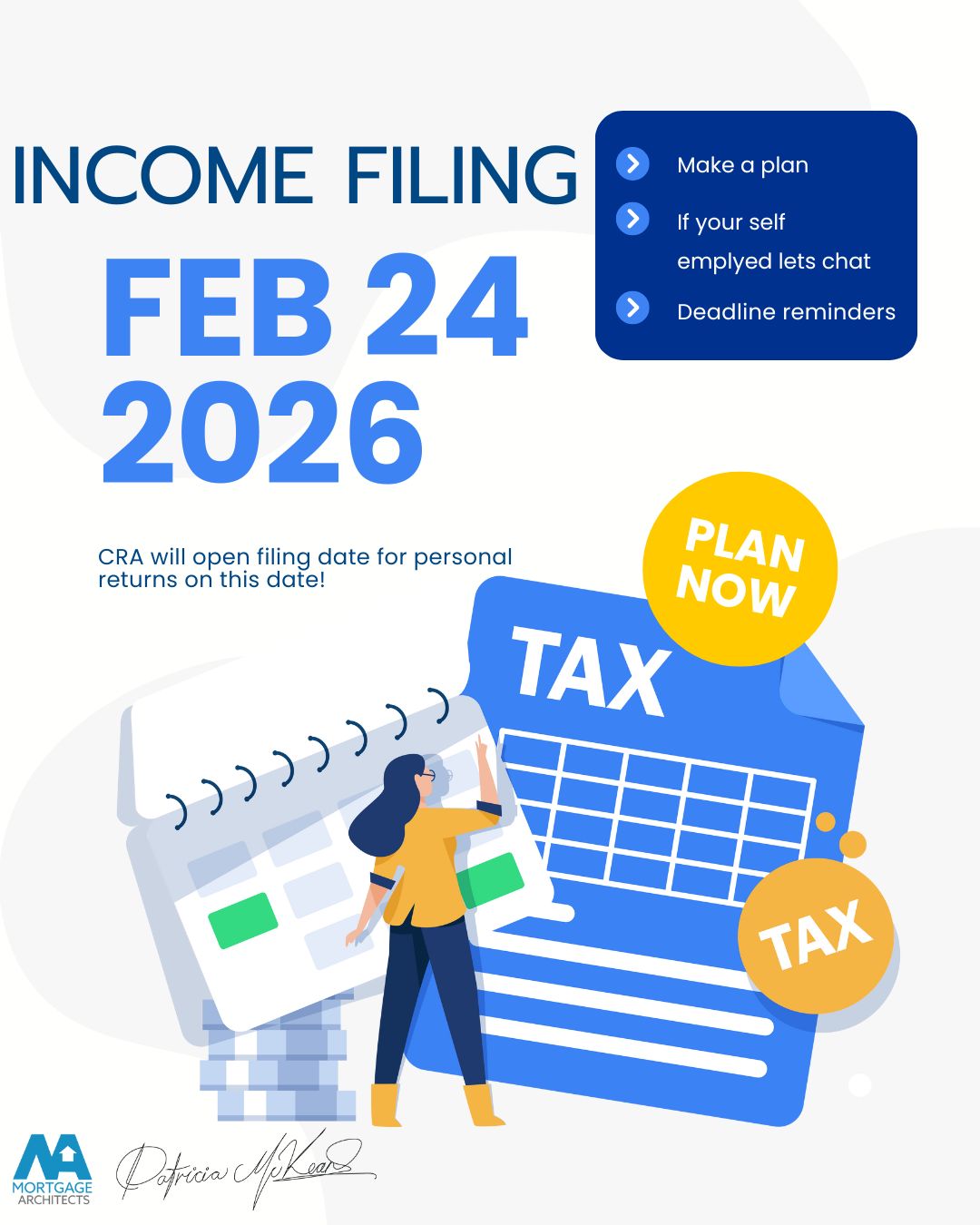

CRA opens personal tax filing on February 24, 2026, but the smartest mortgage plans start before you file.

If you’re self-employed, commissioned, or have uneven income, a little planning now can make a big difference later. You’re not alone in feeling unsure, we see this every tax season.

In this article

- Why your tax return impacts your mortgage

- How write-offs can help (and hurt)

- What lenders really look at for self-employed income

- A real Alberta case study

- Key terms to understand

- Common questions we hear every tax season

Why your tax return matters for mortgage approval

Your tax return isn’t just for CRA. Lenders use it as a primary document to decide how much you can borrow and which lenders will say yes.

For self-employed and variable-income borrowers, lenders focus on:

- Net income (not gross revenue)

- Income trends over time

- Consistency and stability

That means decisions you make for tax purposes can directly affect your mortgage options.

Write-offs: helpful for taxes, risky for mortgages

Write-offs lower your tax bill. That’s good.

But they also lower your reported net income, which is what most lenders use to qualify you.

Here’s a simple example:

- Gross business income: $120,000

- Expenses and write-offs: $40,000

- Net income on your tax return: $80,000

For mortgage purposes, many lenders will only recognize the $80,000, not the $120,000 you actually earned.

Without planning, borrowers are often surprised to learn they qualify for less mortgage than expected, even though their cash flow feels strong.

What lenders look at for self-employed borrowers

Most lenders will review:

- The last two years of tax returns

- T1 Generals and Notices of Assessment

- Consistency or growth in income

- Reasonableness of expenses for your industry

Some lenders are flexible. Others are strict. The difference often comes down to how your income is structured and reported.

This is why timing and strategy matter before you file.

Case Study: Planning before filing makes the difference

One of our Alberta clients was self-employed in construction and planning to refinance in late 2025.

- Actual annual earnings: about $110,000

- Typical write-offs: around $35,000

- Expected net income if filed normally: $75,000

At $75,000 net income, the refinance options were limited and higher-rate lenders would likely be required.

By planning before filing, the client adjusted their strategy with their accountant:

- Slightly higher taxable income

- Clear documentation of business stability

Result:

- Stronger lender options

- Lower rate

- Easier approval

The math wasn’t complicated, the planning was the key.

Thinking about a mortgage in 2025 or 2026

If you plan to:

- Buy your first home

- Refinance to consolidate debt

- Renew and need flexibility

- Access equity for business or life changes

Then your tax return is part of your mortgage strategy, not a separate decision.

Talking before you file gives us options. Talking after you file often limits them.

Glossary

- Net Income – Income after expenses and deductions, the key number lenders review

- Gross Income – Total revenue before deductions

- Write-Offs – Business expenses claimed to reduce taxable income

- T1 General – Your personal tax return summary

- Notice of Assessment – CRA’s confirmation of your filed tax return

- Self-Employed Borrower – Someone earning income outside traditional employment

- Variable Income – Income that changes month to month or year to year

FAQs

Should I stop claiming write-offs if I want a mortgage?

No, but you should understand the trade-offs and plan properly before filing.

Do lenders look at gross or net income?

Most traditional lenders focus on net income, especially for self-employed borrowers.

Is one bad tax year a deal breaker?

Not always. Context and planning matter, especially if income is improving.

When should I talk to a mortgage professional?

Ideally before you file your taxes, not after.

Can planning really change my approval?

Yes. We see it every year.